Goldco Valuable Metals is some of the respected gold IRA companies within the United States. Gold IRAs fall underneath IRA rules for self-directed IRAs, which permit for tax-most popular remedy of other assets, but the foundations governing contributions are the same as for a conventional IRA: In 2022, you possibly can contribute up to $6,000 in case you are underneath the age of 50, and as much as $7,000 if you’re older. As an alternative, its beta is totally unlike these different property-so much so that it offers a true counterweight in opposition to the volatility of stocks. The yellow metal has always kept tempo with (or outperformed) the speed of inflation in the long run. • Buyback fees: Some gold IRA companies cost buyback fees. Investing in physical assets is one way to diversify. We’re dwelling in an period of traditionally unparalleled authorities spending ranges, all-time-excessive public debt, growing distrust in an irrational stock market, political instability and polarization, a once-in-a-lifetime public health situation and, extra lately, the ravages of inflation.

Goldco Valuable Metals is some of the respected gold IRA companies within the United States. Gold IRAs fall underneath IRA rules for self-directed IRAs, which permit for tax-most popular remedy of other assets, but the foundations governing contributions are the same as for a conventional IRA: In 2022, you possibly can contribute up to $6,000 in case you are underneath the age of 50, and as much as $7,000 if you’re older. As an alternative, its beta is totally unlike these different property-so much so that it offers a true counterweight in opposition to the volatility of stocks. The yellow metal has always kept tempo with (or outperformed) the speed of inflation in the long run. • Buyback fees: Some gold IRA companies cost buyback fees. Investing in physical assets is one way to diversify. We’re dwelling in an period of traditionally unparalleled authorities spending ranges, all-time-excessive public debt, growing distrust in an irrational stock market, political instability and polarization, a once-in-a-lifetime public health situation and, extra lately, the ravages of inflation.

Personally, I imagine that it is important to be prepared for any kind of situation since you by no means know what goes to happen. The inner Revenue Service has rules concerning the kind of coins that can be kept in IRAs. Advantage Gold Evaluation 2022 Rankings Complaints And Customer Reviews A gold ira allows you to personal physical gold bullion while also benefiting from the tax benefits of a person retirement account. One other good option could possibly be Noble Gold Investments. If you treasured this article so you would like to receive more info with regards to image source please visit our site. There are a number of exceptions to those early withdrawal rules. Identical to every other IRA, you won’t have the ability to make early withdrawals out of your gold IRA without paying a penalty to the IRS. There are necessary withdrawals for your traditional IRA called required minimal distributions (RMDs), beginning whenever you attain age 72 (or 73, beginning in 2023). The withdrawal quantity is calculated based mostly in your life expectancy, and Which Gold Ira Company Is Best it is going to be added to that yr’s taxable revenue.

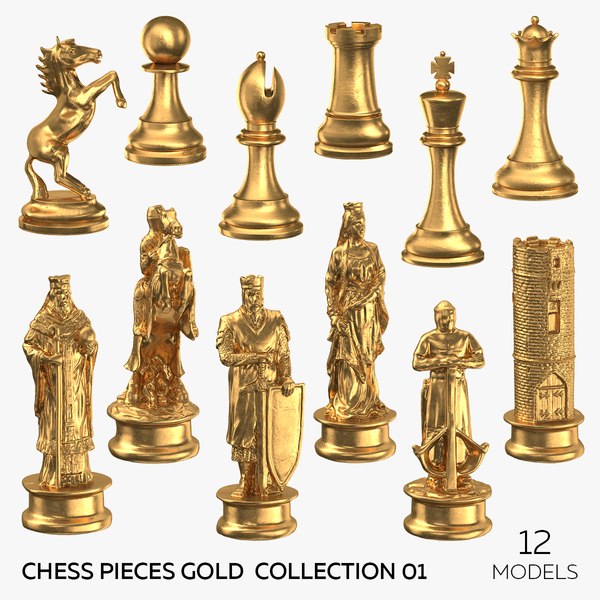

Yes, you may convert your present IRA or 401(ok) right into a Gold-Backed IRA by means of the rollover course of. We’ll stroll you through our high five choices now offering a short overview of what makes these corporations better than their rivals. Word that this portfolio again has minor Which gold ira Company is Best exposure to the inventory market and major publicity to inversely moving bond markets, so its returns have been positive in 4 out of the five years even with out the additional diversification in gold. Like 401(ok)-type plans, chances are you’ll face a tax hit and a penalty if you withdraw the money early, which makes them much less engaging to investors who need more flexibility in the short term. If you’re youthful than 59.5 years of age, there’ll even be a ten % penalty assessed on the worth of the withdrawal. An asset that has built-in value just by existing within the kind we find it within the earth. It’s very evident that Noble Gold, as a seasoned supplier on this sector, provides benefits that cannot be matched by its opponents. They provide a wide collection of gold-plated bodily bars in addition to silver coins.

If you happen to resolve you should access your money before you flip 59½ years previous, you’ll must quit 10% of the amount when you withdraw your gold and liquidate it. To buy valuable metals within your retirement accounts you must arrange a new account with a trustee that specializes in self-directed retirement vehicles. If you happen to select to place your money into an gold IRA, you will be required to pick out between coins and bullion. What’s going to I do if my investments don’t pan out? On the subject of selecting an organization to safeguard your belongings, we understand the significance of constructing the fitting decision. Furthermore, the agents of the corporate deal with buyer satisfaction relatively than selling techniques. It should go without saying that a company with an impeccable popularity and buyer satisfaction profile should take priority when searching for a gold IRA supplier. This article is an effective start to understanding and making use of bodily gold in your retirement plan, but don’t stop here-keep looking on-line, ask a lot of questions whenever you connect with providers, and possibly even discover out what other individuals are saying about gold IRAs and the gold IRA companies that serve traders like you.

Savvy investors may discover peace of thoughts knowing that they’ve the ultimate say over where their retirement savings are going. This is a drawback frequent to many sorts of retirement accounts, not simply a gold IRA. If you’ve been chafing at limited investment choices with your present retirement accounts, maybe it’s time to start out pondering a few self-directed gold IRA. Don’t let the positive factors you’ve made vanish into thin air. While gold could make great features year to 12 months, charges can eat into some of those features, which may discourage these with smaller sums invested. Though gold in a Gold-Backed IRA belongs to the account holder, taking physical possession earlier than retirement age may end in taxes and penalties. At age fifty nine ½, you’re eligible to take distributions as physical gold or money. What’s going to I do if inflation erodes my money financial savings? As an alternative, sell the gold inside your IRA and take a cash distribution or switch the funds into a traditional IRA earlier than taking distribution. The clock begins ticking from the day you really receive the distribution. Contributions to conventional IRAs are tax-deductible, while withdrawals from Roth IRAs are tax-free.