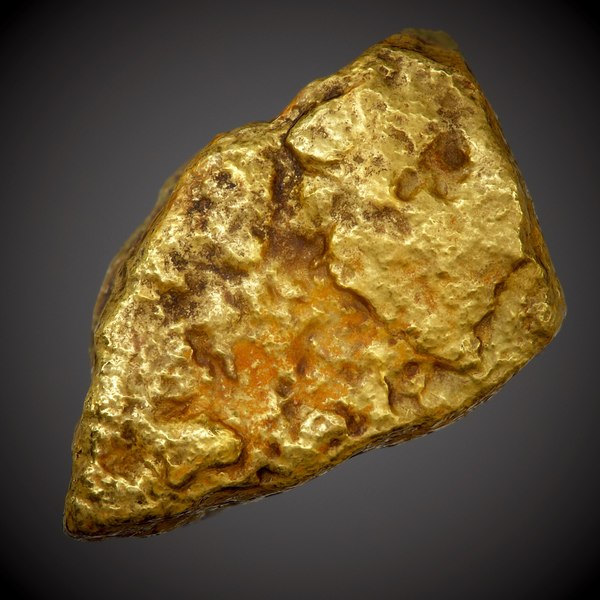

The two principle routes for putting sources into gold in your IRA are paper and physical golds like bullion and coins. Upon further checking, the highest 4 companies on this listing adhered to the strictest ethical pointers. If you’re transferring to a brand new job, rolling over your employer-based IRA or 401(ok) to a new IRA makes it simple to keep all of your retirement funds in one place, and you won’t be penalized should you follow the appropriate guidelines. Apart from this, you’ll also be saved from tax penalties which can be usually imposed whereas transferring property into investments. IRA investments provide liquidity, which is the ability to convert your assets into money shortly and simply. Since it’s a physical object, you can keep it in your possession or secure it in a vault. That’s why in relation to liquidation it also is sensible to have coins in your possession as an alternative of bars. Gold has been used for centuries as a form of forex and security, so it only is smart to include it in your retirement portfolio.

When the worth of your foreign money drops, best gold ira companies buyers seek gold as a haven. Google was based by Larry Web page and Sergey Brin while they were college students at Stanford University, best gold ira companies and was officially launched in September 1998. At the moment, Google accounts for 57.5% of all critiques worldwide and was among the leaders in empowering clients to share their experiences and talk with businesses. Since launching opinions in its Google Local serviced in 2005, Google has enforced several necessities on these critiques: they’re all completely voluntary. That’s most likely why practically two-thirds (63.6%) of individuals check Google reviews before visiting a business. For over 100 years, since 1912, the BBB has offered providers to set standards for ethical business conduct and help prospects determine trustworthy businesses. Here are some regularly requested questions about the perfect gold-backed IRAs, why Augusta Treasured Metals is the best-rated gold investment company, and whether a gold-backed IRA is an efficient funding. Their crew of business consultants prioritize their clients’ pursuits and provide an array of providers to assist you in making the most sound funding. The most effective gold-backed IRA firm will finally rely in your particular person wants and preferences.

When the worth of your foreign money drops, best gold ira companies buyers seek gold as a haven. Google was based by Larry Web page and Sergey Brin while they were college students at Stanford University, best gold ira companies and was officially launched in September 1998. At the moment, Google accounts for 57.5% of all critiques worldwide and was among the leaders in empowering clients to share their experiences and talk with businesses. Since launching opinions in its Google Local serviced in 2005, Google has enforced several necessities on these critiques: they’re all completely voluntary. That’s most likely why practically two-thirds (63.6%) of individuals check Google reviews before visiting a business. For over 100 years, since 1912, the BBB has offered providers to set standards for ethical business conduct and help prospects determine trustworthy businesses. Here are some regularly requested questions about the perfect gold-backed IRAs, why Augusta Treasured Metals is the best-rated gold investment company, and whether a gold-backed IRA is an efficient funding. Their crew of business consultants prioritize their clients’ pursuits and provide an array of providers to assist you in making the most sound funding. The most effective gold-backed IRA firm will finally rely in your particular person wants and preferences.

Who is it applicable for? Basically, you take your hard-earned money, and turn it into gold, saving it afterwards quite a few years of life. There are many various choices obtainable, so it’s important to compare charges and charges in addition to the quality of customer support. Yes, it’s secure to place your money in a gold IRA In the event you choose one of many respected companies on this checklist or carry out your own analysis. One area where Augusta Valuable Metals stands out is the standard of its instructional materials. There isn’t any second thought to the very fact that each professional, all through his working life suppose in regards to the plans the place he can make investments and secure his put up retirement life. Usually, you possibly can count on to pay between $100 and $four hundred to arrange an account. For instance, for those who choose to use your withdrawal for certified greater education bills, you won’t pay the 10% penalty. It’s possible you’ll need to pay a one-time payment to set up your account. Earlier than opening such accounts, a detailed overview is critical since your effective return may be decreased if the account holder does not perceive the associated fee structure and charges.

Additionally, storage charges for holding bodily gold add up over time as it requires secure area that may be quite expensive depending on how much quantity you own. The fees related to a Best Gold IRA can fluctuate depending on the custodian and storage facility. In this course investors will acquire the information that can help them avoid rookie mistakes and possibly save 1000’s of dollars. Investing in valuable metals can be an awesome method to hedge in opposition to inflation and protect your onerous-earned cash. By way of actual estate IRA rollover, you’ll be able to switch the funds in your previous retirement plan to your new IRA account. When it comes to purchasing gold bullion or gold coins – both are valued the identical manner – the spot value per ounce. To conclude, we consider Goldco is the top alternative in terms of the best gold IRA companies. If you need to stay clear from IRS fines, you must examine how IRAs are taxed. If your retirement account accommodates taxed funds as a substitute of untaxed funds, you’d must roll the cash into a Roth IRA instead.

A gold IRA rollover lets you switch funds from a standard IRA or 401(k) account into a person Retirement Account (IRA) backed by treasured metals. The strategy is nice for weathering market fluctuations without sacrificing progress potential. One in all the major differences between bars and coins is that if you promote coins sometimes you’ll get a number of dollars over melt value, or market worth. Study the basics so you can get a return on your funding. Risks are all the time involved when shopping for online; subsequently, it’s at all times sensible to reduce your risks by shopping for simply small amounts of gold or silver.Many fraudsters are on the market to steal your money; due to this fact, whenever you buy small amounts of steel bullion, you keep them off. Their perception is that customers ought to have the ability to make a sensible shopping for decision based mostly on unbiased feedback and analysis-driven data. Named a “Major Gold and Silver Dealer” by Newsmax, consumers have given excessive rankings to Birch Gold Group on trusted, unbiased web sites. ConsumerAffairs gives skilled sources and verified reviews to assist customers make smarter buying decisions. A monetary advisor or an skilled can advise you on gold IRAs if that is your first funding. Folks belief the professional consultants at Augusta Treasured Metals – that a lot is obvious. Many people choose to arrange IRAs (individual retirement accounts) through the years they work (the earlier the better) to ensure the funds they want will be prepared and ready after they retire. It has every part you’ll want to learn about investing in gold and protecting your retirement portfolio.