How Will we Use Gold in the fashionable World? A simple and effective manner for traders to entry gold in an IRA would be to make use of the massive and established bodily gold-backed trade traded funds (“ETF”) market. Don’t hesitate any longer; begin at this time and get pleasure from the benefits of a gold IRA for years to return. Funding a Gold IRA may be executed by different strategies: direct transfers from an current IRA or 401(ok), rollovers, or cash contributions. The opinions also mention the company’s delivery pace, coin choice, trustworthiness, and low fees. Our household historical past within the valuable metals business dates back to the 1970s with Midas Gold Group incorporated in 2010 with specialization in Gold IRAs and fast and best gold IRA secure nation-extensive precious metals supply and choose-up. Gold also carried out spectacularly in the course of the 1970s stagflation, notching annualized gains of over 30% over the course of the decade.

How Will we Use Gold in the fashionable World? A simple and effective manner for traders to entry gold in an IRA would be to make use of the massive and established bodily gold-backed trade traded funds (“ETF”) market. Don’t hesitate any longer; begin at this time and get pleasure from the benefits of a gold IRA for years to return. Funding a Gold IRA may be executed by different strategies: direct transfers from an current IRA or 401(ok), rollovers, or cash contributions. The opinions also mention the company’s delivery pace, coin choice, trustworthiness, and low fees. Our household historical past within the valuable metals business dates back to the 1970s with Midas Gold Group incorporated in 2010 with specialization in Gold IRAs and fast and best gold IRA secure nation-extensive precious metals supply and choose-up. Gold also carried out spectacularly in the course of the 1970s stagflation, notching annualized gains of over 30% over the course of the decade.

Identical to any other IRA, the gains you make with a gold IRA accrue tax-free. Buyers should discuss their particular person circumstances with their applicable investment professionals before making any determination relating to any Companies or investments. And our skilled representatives can answer any questions you might have about shopping for gold. It may possibly help you keep away from high taxes in retirement and wealth in the long term. Its counter-cyclical nature usually ends in worth will increase during economic downturns or high inflation. They noticed what occurred in 2008, when markets misplaced more than 50% of their worth while gold gained 25%. They usually understand that holding gold can make sense as a countercyclical asset, as gold has a tendency to actually shine when monetary markets are experiencing weakness. You can rollover qualified funds from your 401k upon getting chosen a custodian and given them all your paperwork. Whereas silver might take a dip in value when there is lots of bullion out there on the market, it by no means completely loses its value like some paper backed securities. Early withdrawal from a Gold IRA earlier than age 59½ incurs a 10% penalty along with common earnings tax. A number of the presents in our comparison are from third-party affiliate partners from which we will receive compensation at no additional cost to our readers.

Identical to any other IRA, the gains you make with a gold IRA accrue tax-free. Buyers should discuss their particular person circumstances with their applicable investment professionals before making any determination relating to any Companies or investments. And our skilled representatives can answer any questions you might have about shopping for gold. It may possibly help you keep away from high taxes in retirement and wealth in the long term. Its counter-cyclical nature usually ends in worth will increase during economic downturns or high inflation. They noticed what occurred in 2008, when markets misplaced more than 50% of their worth while gold gained 25%. They usually understand that holding gold can make sense as a countercyclical asset, as gold has a tendency to actually shine when monetary markets are experiencing weakness. You can rollover qualified funds from your 401k upon getting chosen a custodian and given them all your paperwork. Whereas silver might take a dip in value when there is lots of bullion out there on the market, it by no means completely loses its value like some paper backed securities. Early withdrawal from a Gold IRA earlier than age 59½ incurs a 10% penalty along with common earnings tax. A number of the presents in our comparison are from third-party affiliate partners from which we will receive compensation at no additional cost to our readers.

Data and statistics are copyright © and/or other mental property of the World Gold Council or its affiliates (collectively, “WGC”) or third-occasion suppliers recognized herein. Different content material is the intellectual property of the respective third social gathering and all rights are reserved to them. You additionally want to find out whether or not the company has been audited by an unbiased third get together. First off, you’ll need to verify you’re holding a “certified coin,” meaning that it’s been graded by a 3rd get together. The forms of bodily gold that can be held in a self-directed IRA include the American Gold Eagle coin, the Canadian Gold Maple Leaf coin, the Austrian Philharmonic gold coin, the American Gold Buffalo coin, gold kilo bars, sure gold bullion bars, Credit Suisse gold bars, and Swiss PAMP gold bars. They include however usually are not restricted to: American Eagle gold coins, Credit score Suisse gold bars, Johnson Matthey gold bars, Valcambi gold CombiBars, and best Gold Ira Canadian Gold Maple Leaf coins.

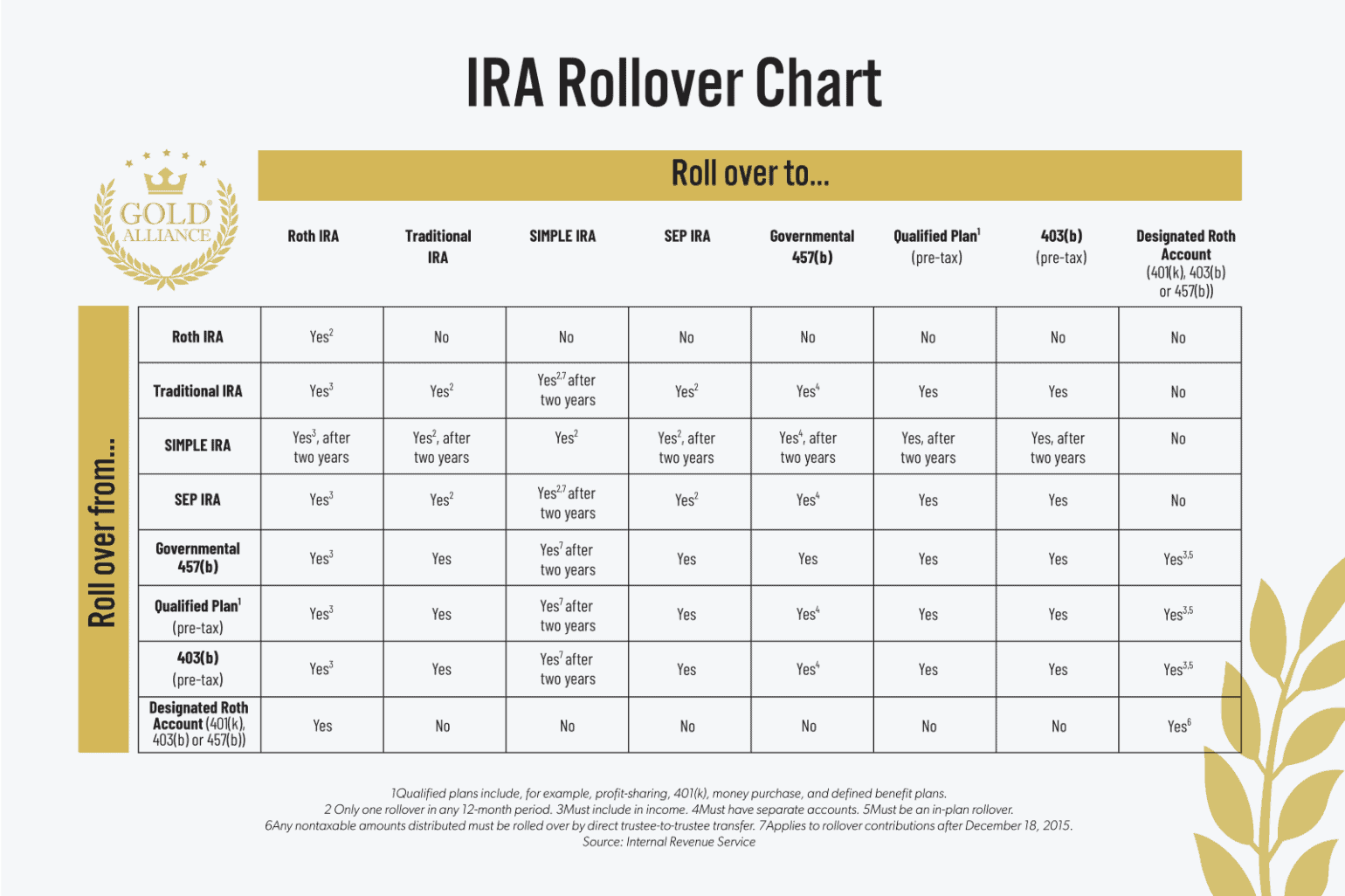

1883, and was an excellent mineralogist who had prospected from Alaska to Mexico. Denver: Colo., 1883, p. That will help you out, best gold ira we’ve researched and created a listing of the best Gold IRA companies of 2023. Our list is based on components corresponding to customer service, funding options, and charges. The process of purchasing gold for an IRA involves collaboration together with your custodian and a trusted vendor. Gold should meet a purity requirement of 99.5%. When selecting gold merchandise, consider elements like market worth, liquidity, and storage necessities. The process for rolling over a 401(ok) into a Gold IRA contains necessities like leaving an employer. It’s necessary to know any specific conditions or limits imposed by IRA custodians or the IRS, such because the one rollover per 12 months rule and reporting requirements. It provides expanded funding opportunities and diversification benefits. A Gold IRA gives further funding alternatives not sometimes available in a 403(b) plan. Suppose you resolve to get a new 401k plan.

RC Bullion is one in all the best gold IRA companies, known for best gold IRA his or her in depth number of coins and bars. On your comfort, I have collected a list of the Best Gold IRA Companies obtainable at the top of this article. Whereas gold is a highly sought-after and safe investment, it’s vital to take the mandatory steps to safeguard it. Whether or not you need to take bodily possession of your gold IRA or not, it’s necessary to work with trusted companions who can make it easier to obtain your goals. If you wish to know find out how to retailer gold at dwelling legally after you’ve had it in an IRA, there are a couple of the way to do it. Final, when you receive the funds, purchase your required metals and store them in IRA-authorized vaults. A consumer needs to make sure that their IRA trustee/custodian presents entry to the suitable types of gold, and that they have the means/capabilities to carry the gold in custody. That implies that you can buy gold by way of your gold IRA with pre-tax dollars, your positive factors will accrue tax-free, and also you only owe taxes when you are taking a distribution. Instead, you’ll owe capital beneficial properties taxes on the quantity you sell the gold for.